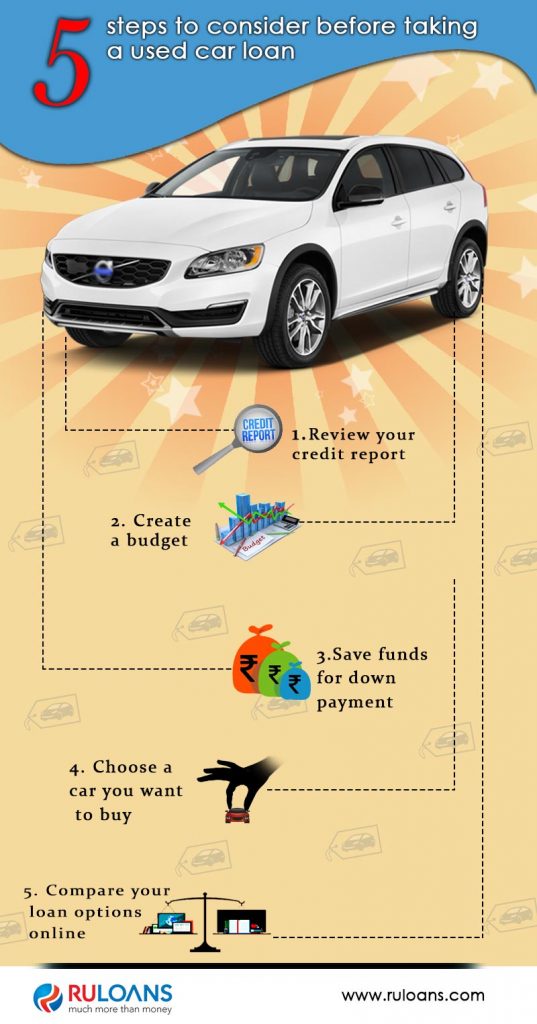

A used car loan is a type of secured mortgage loan offered by leading banks and NBFCs in India. The loan is given to people to help them buy a second hand/used car. Banks and NBFCs grant a used car loan if the loan borrower has a strong credit score. One also needs to have a strong financial plan before applying for a used car loan. One has to pay a specific down payment while buying the car and later regular EMIs. Considering these financial obligations, one has to be careful with the financial planning. Once you have the down payment amount ready, you can choose the car you want to buy. Stick to your choice of car or your budget will keep fluctuating.

One can easily apply for a used car loan online on Ruloans. You can check your eligibility, compare your loan options, upload documents and apply online at www.ruloans.com for used car loan.