Buying your own house is a dream for every Indian. It gives a sense of pride and responsibility to the owner of the house. But the due to the inflation and rising rates in real estate across the nation; one simply cannot buy a house using their savings. A person has to take a home loan to buy, construct or expand any residential property. You can get an instant home loan from any bank or NBFC if you meet the criteria. But they only fund 85% to 90% of the house amount. The remaining 10% to 15% of amount is supposed to be paid by the loan applicant from his or her own savings.

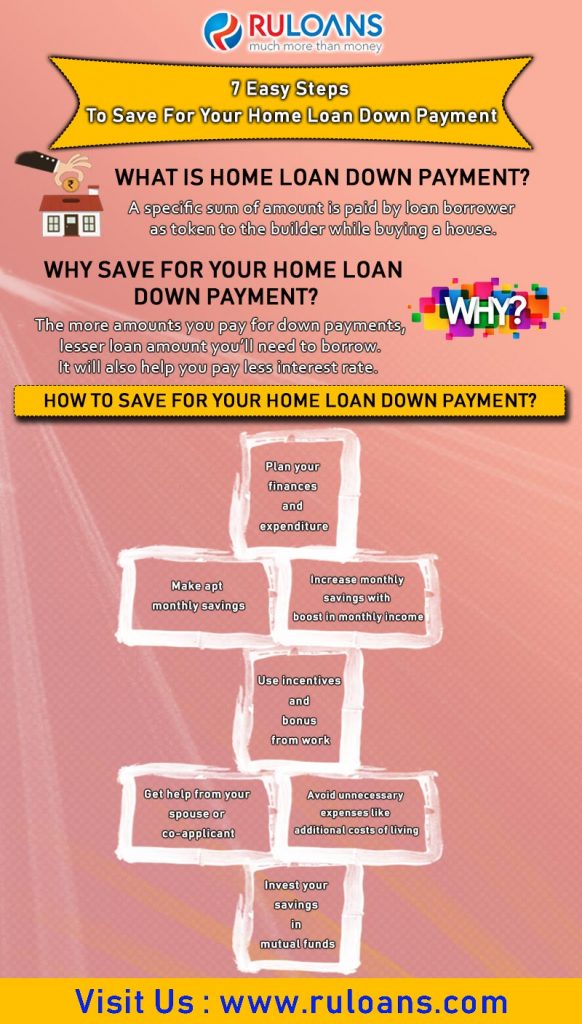

Though its just 10% to 15%, it can prove to be a financial burden. One has to initiate proper planning and require time to save such a big amount. There are ways one can opt for to start saving for home loan down payment. Refer the image below to know how.