A loan can be proven as a financial burden on some people. But in today’s world of crunching finances, it is becoming difficult day by day to pay for various expensive commodities by using sole savings. Be it buying a house, planning a wedding, funding a medical emergency or buying a second hand car, we need extra finances on various steps of our life. The best way to fund your financial needs is by taking a suitable loan as per your requirements.

In India being in debt is considered as a negative façade of someone’s profile. Thus we Indians always look out for ways of getting debt free as quick as possible. No matter how bigger or smaller the debt is, the quick we pay it off, the more relived we feel.

Banks and NBFCs offer EMI (equated monthly installment) option to pay off your debt. By this way you can pay off your loan on monthly basis. The loan amount and interest rate are divided into a number of installments keeping in mind the tenure and that forms an amount for the EMI.

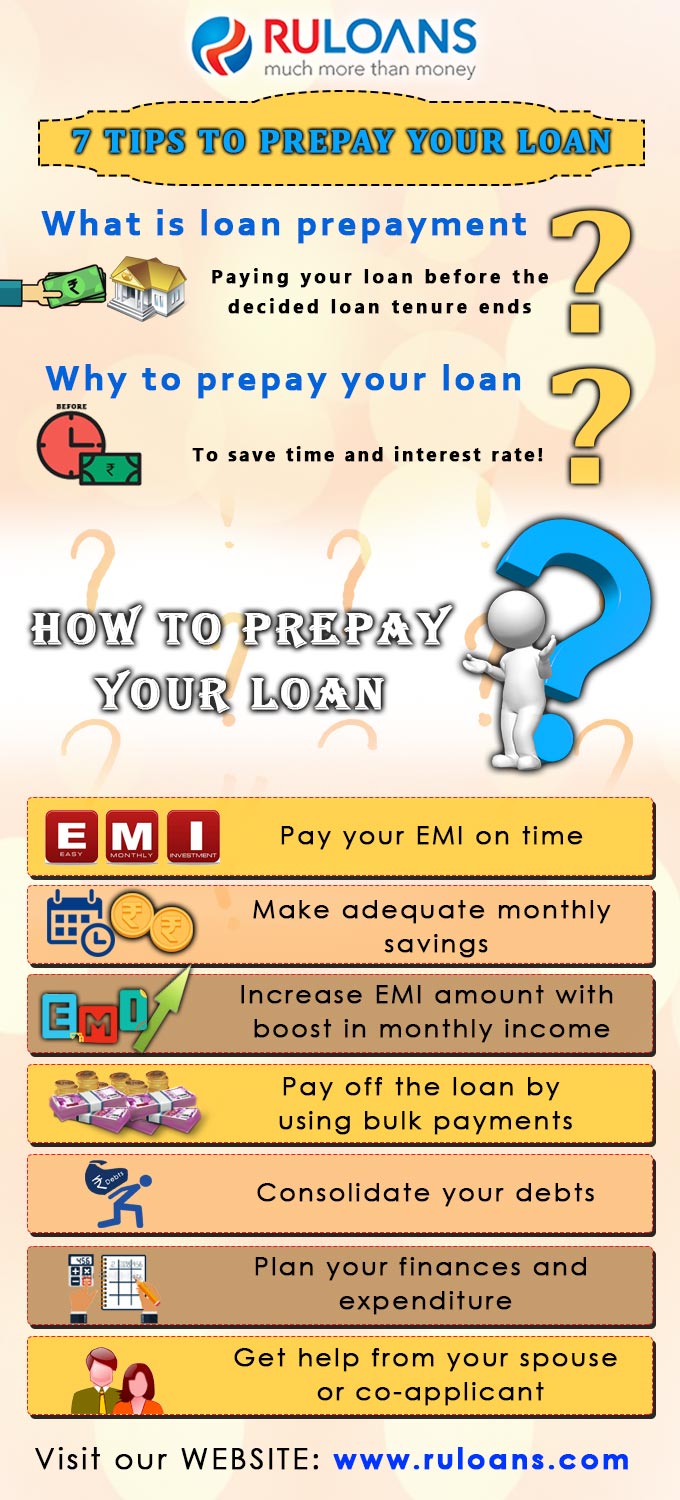

Apart from the EMI, there are more ways to get debt free sooner than desired. Follow the given guidelines to get debt free in no time