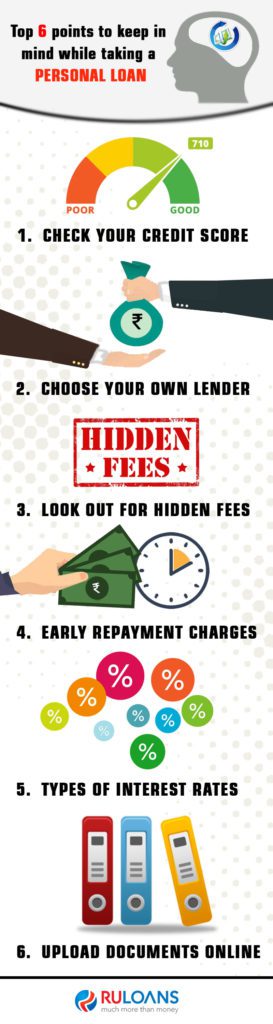

A personal loan helps you fulfill personal and professional needs as and when the time arises. This gives us a temporary relief. But before we could consider taking a loan we need to be clear with our requirements. Also, we need to understand our financial position and many other things before you make a choice of taking a loan. Hence we have compiled a list of 6 points you need to consider while taking a personal loan;

To use in info-graphic for the image:

- Check your credit score:

The lender will definitely check your financial condition and your credit score be checked thoroughly.

- Choose your own lender:

There are many lenders in the market. You can choose your lender online from a list of banks and NBFC’s by applying for a loan on Ruloans.

- Hidden Fees:

There are hidden fees and processing charges. You need to read everything so you’re not surprised later.

- Early Repayment Charges:

It’s beneficial to know about the charges you will have to shell out while repaying the loan earlier than the proposed tenure.

- Types of Interest Rates:

You can go for fixed or floating rate of interest as per your requirement.

- Documentation:

At Ruloans, you can upload your documents online. This helps in processing your application in a smooth manner.