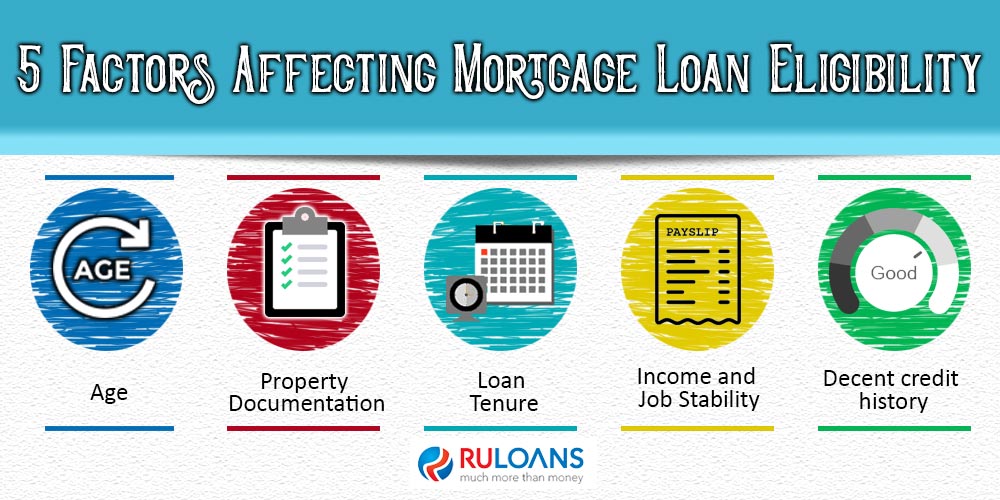

The loan against property eligibility depends on few aspects which deal with your income and credit history. Other factors deal with your property documents. Absence of any of these documents might get your loan application rejected. Hence these aspects need to be taken seriously.