Many of us have been repaying long term loans like “Home loans” and “Loan against property” at higher interest rates. The EMI and interest burden is a lot to handle and the common man in India is living hand to mouth by repaying the loan amount and handling household expenses.

What if you got to hear that the NBFC from where you have taken a loan has INCREASED INTEREST RATES BY 2%?

This news is enough to bring a lot of tension among the masses and the common man will now suffer more than ever. They will now have to pay a higher EMI. But we at Ruloans are here to ensure this does not happen. With over a decade of experience in the loan industry, we are well versed with the trends in the industry. Our customers always come first for us and hence we help our customers borrow right and provide them with services that are much more than money. After getting a home loan or loan against property from us, you can always come back to us for help in such a scenario as we have the best solution for you.

The solution is LOAN BALANCE TRANSFER!!

Yes. Since the NBFC is increasing interest rates by 2%, they have been going through a liquidity problem. Hence as a borrower, you can use the facility of a Balance Loan Transfer where you can shift your current loan from the NBFC to any Bank which offers this facility.

Why should you take Loan Balance Transfer?

With a loan balance transfer there are many benefits to the common man. These are,

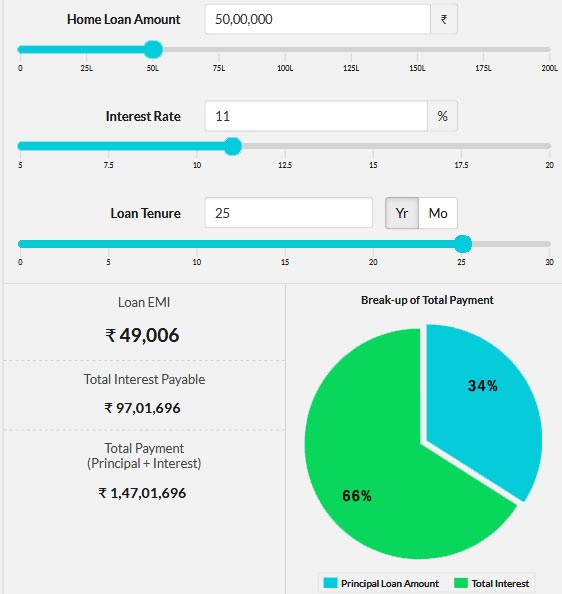

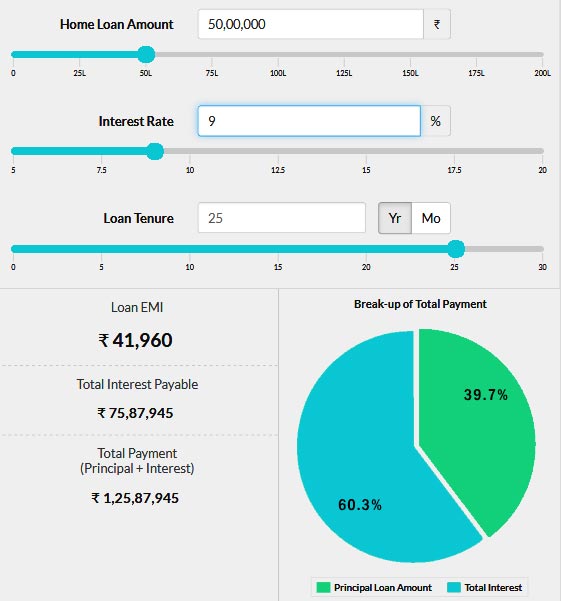

Lower Interest Rates – This is the main reason for borrowers to switch their loan from NBFC to a Bank today. Since the NBFC increased their interest rates up to 2%, shifting the loan to a Bank which is offering a lower interest rate will definitely help in saving a lot of interest money.

Lower EMI – The next best benefit for the borrower is post shifting the loan to a Bank, the interest rates are lower and hence there would be a lower EMI which will have to be paid every month. This will help in saving a lot of money which he/she would be paying if they had continued with the NBFC.

A good credit score helps – Yes, if you have a good credit score, it definitely helps. The bank will view you as a credit worthy person and hence will offer you better interest rates, better loan terms and might also waive off few charges too.

Top-up Facility can be provided – Post transferring your current loan from the NBFC to the Bank, your new lender can provide you with this facility where you can get a Top-up loan on your outstanding loan amount. You can use this short term loan amount for debt consolidation or for any of your financial obligations.

Case 1 NBFC

Case 2 Bank

With this rate hike by the NBFC’s there will be a lot of crisis in the NBFC market and with their liquidity problem rising, it is wise to take the “Loan Balance Transfer” facility and save your hard earned money. With Ruloans, we can help you choose and compare from the best banks available in the market that offer balance transfer. Hence, in case you plan to shift your home loan, loan against property, business loan, personal loan balance transfer from an NBFC to a Bank.