Personal loans have been helping millions of customers in India. Whether you have one problem, 10 problems or even a 100 but with a personal loan, that can be easily solved. That’s why this loan has always been the most popular loan among the masses.

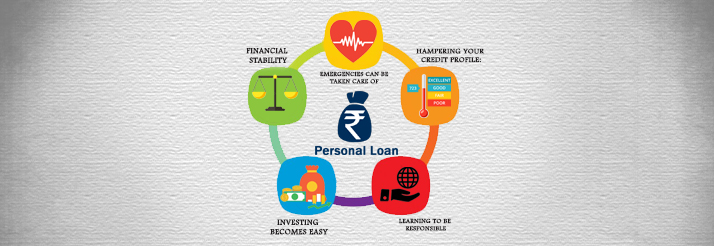

Today, we have decided to tell you about 5 lessons that will help you understand more about Personal loans. These lessons are learned by most of our customers and we speak through their experience.

Financial stability:

One most important lesson what a personal loan teaches you is financial stability. The reason you opt for a personal loan is the absence of savings. Hence a personal loan becomes like a wakeup call which makes you realize that you need to be stable financially or else end up taking loans all your life.

Hampering your credit profile:

We take a personal loan because our needs/expenses are more than what we earn/save. For each month you take the loan, you must repay an EMI which is high. If you fail to repay it once, it can affect your credit profile. A bad credit profile is bad for your future loan decision.

Investing becomes easy:

There are times when you need money to invest in the stock market, education or a necessity. These are very important to you but absence of savings doesn’t allow you to do anything. Hence with a personal loan, investing in all these things becomes easy.

Emergencies can be taken care of:

When emergencies strike, it can be very difficult to arrange for cash immediately. But with paperless personal loans, it can be easy for you to get a pre approved loan amount within a few hours! So you can deal with your emergencies!

Learning to be responsible:

It was very easy for us to ask for pocket money and have fun with the help of our parent’s money. But when we grow up and earn, that’s when we understand how responsible we must be in order to handle our expenses and maintain savings.

You can also read – What is the minimum salary for personal loan?