Home loans are loans advanced to assist in the purchase of a house or a flat. To be precise, home loans are secured loans where the borrower pledges the house to be purchased as collateral, which then becomes secured debt.

Likewise, mortgages are legal agreements by which banks, financial institutions, etc., let you borrow money on interest in exchange for title of your property, on terms that the conveyance or commitment of title becomes void upon repayment of debt. In short, when you convey commit your property to a creditor as security, you get a loan for your required purpose. Thus, mortgages are secured loans.

Similarly, loans against properties are loans that are approved after taking into custody landed possessions such as pieces of land, houses, commercial estates, or realty as collateral or guarantee until the loans amounts are recovered. Characteristically, loans against properties are secured debts, and are sometimes referred to as mortgage loans.

Therefore, you might ask how do home loans differ from loans against property. Well, home loans are loans taken for buying or purchasing a house, a flat, plot of land, or an under-construction property. Loans against property are one-step further, where you can borrow or take a loan for myriad personal purposes ranging from funds for medical expenses and marriages, to expenses for vacations and business expansion. This goes to also mean that your home, house, or property will be used as mortgage to secure your borrowings.

Let’s take a closer look at how home loans differ in comparison to loans against property.

- Term of Loan

Most home loans can be taken for a maximum period of 30 years, whereas loans against property are allowed for a period that does not exceed 15 years. However, this may differ from lender to lender. - Purpose of Loan

You may seek a home loan for purposes such as buying, or purchasing a house, a flat, a plot of land, or a property under construction. The purpose of these loans are limited to activities related to homes, and living spaces. On the contrary, you may seek a loan against your property for varied purposes. This means that borrowings may be used for personal reasons, for business inclusive of commercial and industrial, or any other use you have in mind. This also means that the property you mortgage could be your personal property, or your industrial or commercial property. - Value of Loan, or Loan-To-Value (LTV)

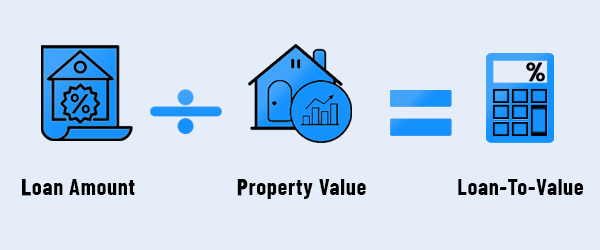

Loan values are appraised in terms of Loan-to-Value ratio. The ratio compares the size of the loan amount you hope to borrow to the appraised value of the property. This means the bank or the lender values your property after a visiting the site in case you seek a home loan or a loan against property. So, if you’re seek a home loan, expect up to 90% of the value of your home, and if you seek a loan against your property, expect up to 60%. The Loan-to-Value ratio may differ from institution to institution.

- Rate of Interest, or Interest Rate on Loan

Interest rates differ according to the types of loans. Generally, higher rates apply for high-risk loans considering the factors of default, and low rates are chargeable on lower risk borrowings. If you’re looking for a home loan, expect a comparatively lower interest rate as low as 8.70%, and on the other hand if you’re looking to borrow against your property, expect interest rates starting at 9.70%. - Tax Exemption on Loan

If you looking for a home loan, you’re in for tax benefits; you have benefits on interest you pay according to section 24, and for the principal amount you enjoy benefits under section 80C. Don’t expect any tax exemption on your loans against property. - Documentation and Processing

You may find the documentation process easy, and your loan sanctioned in as less as 15 days if you’re looking for a home loan. On the other hand, if you’re seeking a loan against your property, expect a thorough check of your property, property documents, and your background. This may take more time than you expect.

For more on Home Loans, read 8 Different Types of Home Loans Available in India.

Now that you’re quite clear in your understanding of home loans, and mortgage loans, or loans against property, try not to use these loans for speculative activity.

Call a Ruloans representative on 1800 2667576 for your next route to success!