Introduction

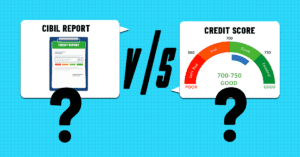

CIBIL is a leading Credit Bureau in India that generates individual credit score reports. A CIBIL score is a reflection of an individual’s credit history. Lenders look at the borrower’s credit score or CIBIL score to evaluate whether to give them a loan or not. CIBIL score is also used for many other financial products and loan approvals. Lenders often classify customers depending on their credit score. The lender’s policies and the CIBIL score of the borrower will determine the rate of interest payable as it determines the financial risk associated with the borrower.

Get your credit card today!

What is a good CIBIL score?

CIBIL score can be anywhere from 300 to 900, and it is better to have a higher score, as the higher, the better. You require a CIBIL score above 750 if you need to get a loan sanctioned. A CIBIL score of less than 750 means the lending institution will outright deny you a loan or offer it at exorbitantly higher interest rates. It is best to have and maintain a CIBIL score of over 750 and as close to 900 as possible. A good CIBIL score equates to having good financial habits and well-being. You get a loan on affordable, flexible terms with a good CIBIL score. Institutions determine your capability and creditworthiness to repay the loan you borrowed on time.

You should know what factors affect your credit score and try to improve it. It shows you are good with money and take care of yourself financially. You can quickly improve your CIBIL score. Let us see four ways of how to increase your CIBIL score:

Maintain a Good Repayment History

The most important and easiest way to increase your credit score or CIBIL score is to have a good history of debt repayment. It is why people who want to increase their CIBIL score avail of loans and try to repay them through EMIs timely. It helps in improving and increasing the CIBIL score. In other words, it creates good debt repayment history. If you handle your car or home EMIs properly and pay it in full, keeping the terms and conditions of the agreement in mind, it is called good debt. Good debt will contribute to increasing your credit or CIBIL score.

Get your credit card today!

Reduce Credit Use

How to increase your CIBIL score quickly? Never breach your limit on your credit card. It would be best if you utilized a maximum of 30% monthly credit. Not exceeding 30% of your credit limit monthly will do wonders for your CIBIL score. For instance, if you have a credit limit of Rs. 10 lakh, ensure you do not use more than Rs. 3 lakh. It would equate to 30% of your credit limit. If you require more funds, first repay the existing debt before applying once more. Borrowers who use more than 30% of their credit limit will generally have a lower CIBIL and credit score. The interest rate they will have to pay on loan will generally be higher.

Report Discrepancies in your Credit Report

Your credit report might have discrepancies sometimes. For example, your lender might not have reported to CIBIL of your timely payments on time. It could result in reducing your credit or CIBIL score. Being a borrower, you must check your CIBIL score regularly and ensure there are no discrepancies. In case you spot any discrepancy, report it immediately and get it fixed. Many institutions allow you to check your CIBIL score for free on their apps or websites. Just register and provide the necessary details to find out your CIBIL score.

Pay Bills Timely

Ensure to pay back your dues in full and on time. Dues include EMIs, credit card payments, etc. Set up payment reminders, so you don’t forget any pending or upcoming payments. Missing a due payment will negatively affect your CIBIL score. It is essential to pay your bills on time as it will help you increase your CIBIL score. You can use different reminders on apps on your phone or desktop as technology can help you remember your payments and even set up automatic payments on various apps.

Get your credit card today!

Conclusion

You can require a loan at any time, and to ensure that your loan gets sanctioned and at a lower interest rate, you should have a good credit or CIBIL score. Always try to follow the above practices, maintain a good CIBIL score, and increase it.

FAQs

Q1. How to increase your CIBIL score?

A1. Here are a few tips to increase your CIBIL score:

- Reduce Credit Use

- Maintain a Good Repayment History

- Report Discrepancies in your Credit Report

- Pay Bills Timely

Q2. What is a CIBIL score?

A2. A CIBIL score is a reflection of an individual’s credit history.

Q3. How to ensure timely repayments?

A3. You can use different reminders on apps on your phone or desktop as technology can help you remember your payments and even set up automatic payments on various apps.