A mortgage loan also called as a loan against property helps you unlock the best value of your property. Since the loan amount is directly related to the market value of your property, you can get a high loan amount. Hence the rule applied here is “Higher the property value, Higher the loan amount”.

In India there are many lenders who provide mortgage loans with attractive offers. You can check different mortgage loan interest rates and choose the bank/NBFC which suits your needs. Before you could apply for a loan against property, you are required to be ready with a list of documents. The process of mortgage loan begins with the bank as they will check your eligibility in order to get a loan against property.

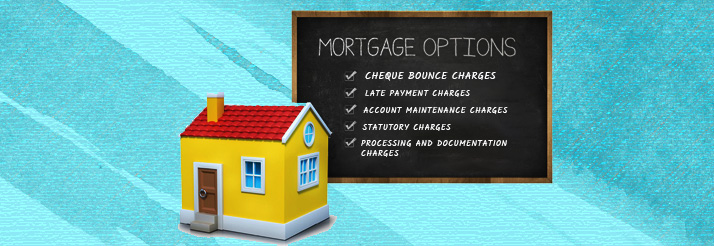

Once you clear their criteria, you can go ahead with applying for the loan. But, before you do that, there are 5 charges which you must be very familiar with. These 5 charges are very important and hence you must have knowledge of it.

- Cheque bounce charges – One bounced cheque has multiple impact on your profile. An amount in the range of 400-600* will be deducted as penalty each time a cheque bounces. Also, your credit score decreases with each bounce. Hence please find out the charges associated with bounced cheques.

- Late payment charges – Apart from a cheque bounce, if you pay the EMI late, there will be a fee levied each time you make a late payment. This charge can be anything above 0.5%*. Hence you must never make a late payment charge as this will affect your credit history.

- Account maintenance charges – Just because your loan account is not a basic savings account, it does not mean the bank will not charge you a specific amount for account maintenance. Although this doesn’t happen usually, it is wise to go and check with your bank in case there are such charges.

- Statutory charges – There are few legal charges which might be levied on you as property is involved here. Hence while taking a mortgage loan, please check with the bank about any of these statutory charges.

- Processing and documentation charges – We have mentioned this in the very end as people usually don’t read the loan application carefully about these charges. While you get your loan application approved, the bank can levy a fee on documentation and processing of the loan application. Hence before signing the application, please read your loan offer, terms and conditions carefully.

Why choose Ruloans?

Apart from having a decade of experience in the field of loans, we are a customer oriented company which wants everyone to borrow the right way. With our state of the art mortgage loan calculator, you can estimate the value, interest rate and term of the loan to pay the EMI you desire.

Your main benefit of choosing us for your loan requirement is that we allow you to compare different lenders in one page. You can check all the offers and choose the best as per your needs. You can upload your documents online and we will help you with the rest of the application.

Hence, if you have any mortgage loan requirements