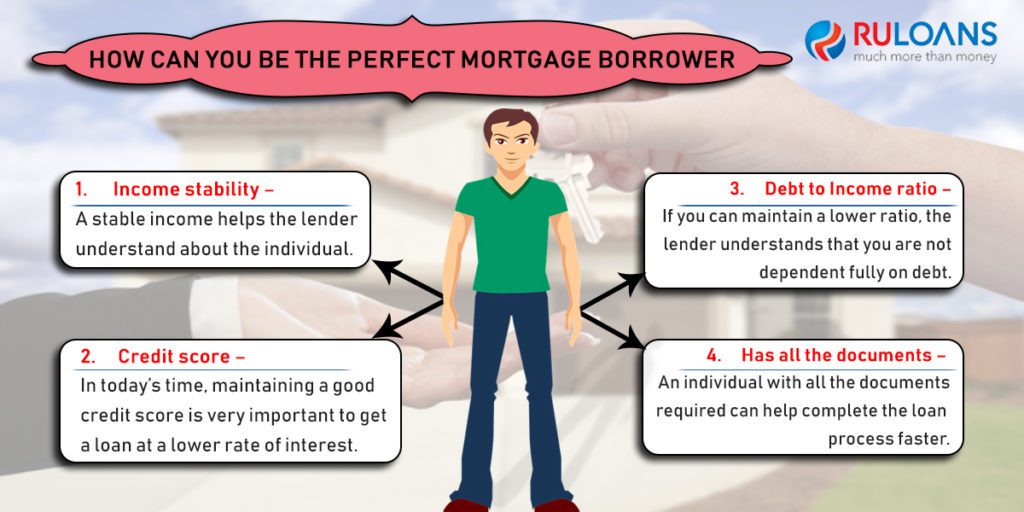

An individual can avail a loan from the lender when they are eligible and can furnish all the documents. By doing so, the individual can get a loan quickly. To make sure you are eligible, you need to work on many factors. Below listed are few such steps you can follow in order to be the perfect borrower for a loan against property.

How can you be the perfect mortgage borrower?

Most searched links

Knowledge Center

©2024 Ruloans — All Rights Reserved

Toll-free Number — 1800-266-7576