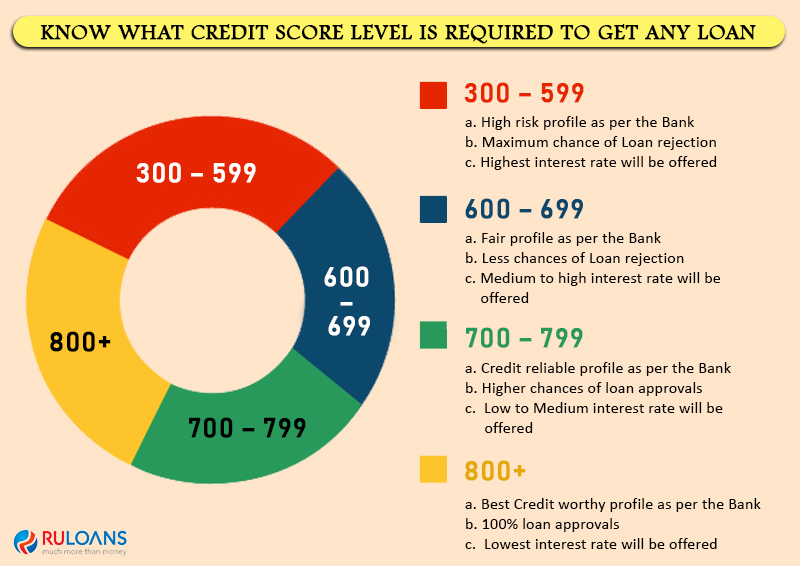

The credit score ranges from early 300 to a maximum of 900. This score is derived by analyzing your credit history, credit utilization, repayment of debts, defaults in loans, bounced cheques and many more. On the basis of these scores, you can apply for loans and get them at attractive interest rates. Here we have mentioned what kind of level will be beneficial for you to get the best loan at the best rates.

Know what Credit Score level is required to get any Loan

Last Updated: April 8, 2019By adminTags: credit Score, Credit Score level is required to get any Loan

Most searched links

Knowledge Center

©2024 Ruloans — All Rights Reserved

Toll-free Number — 1800-266-7576