Are you tired of paying a high EMI on your home loan?

What if we give you a solution where you can save money in lakhs?

Yes, you can save EMI + interest money in lakhs.

Do you want to know what the solution is?

This special solution is “Home Loan Balance Transfer“!

What is a Home loan balance transfer?

Sometimes, we opt for a home loan at a high rate of interest. But in some time a new Bank is offering a lower rate of interest. This is when you can opt for a balance transfer and shift your loan to the new Bank. This is a loan that one can apply for when they feel they are paying high EMI and wish to pay a lower EMI.

How much money can I save on my Home loan Balance transfer?

Let us understand this with 1 example.

Example 1: – Mr. Kumar

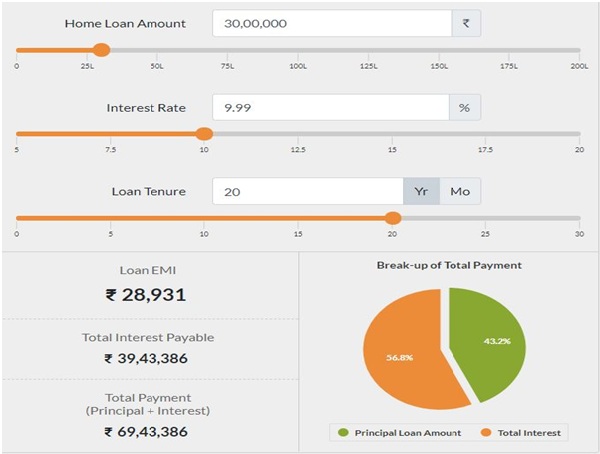

Mr. Kumar is a middle-class man who works for a private company on a salaried basis. He wishes to get a home loan from ABC Bank for 30 lakhs so he can buy his dream home. Here are the details.

Loan amount – 30 lakhs

Interest rate – 9.99%

Loan tenure – 20 years

MONTHLY EMI – 28,931

Total Interest paid for a home loan – 39.5 lakhs

As you can see, this is the amount he will be paying to ABC Bank.

Now after some time, Mr.Kumar realized that XYZ Bank is giving a very low-interest rate on home loans. He knows that he can save a lot of money there. That’s when he comes to Ruloans and applies for the best Home loan balance transfer.

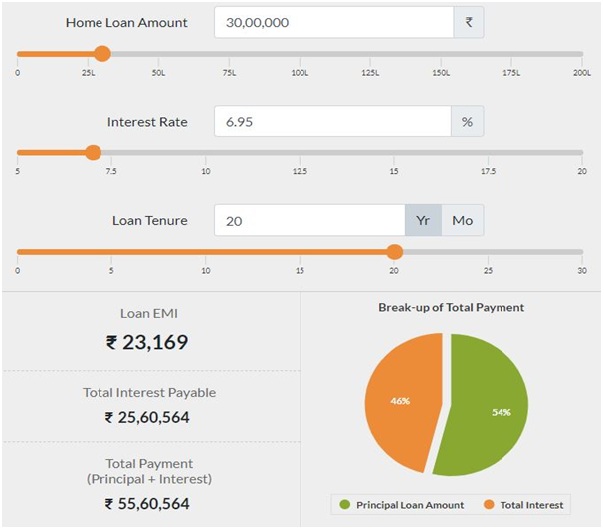

Let’s see what happens when Mr.Kumar applies via Ruloans for a Balance transfer:

Loan amount – 30 lakhs

Interest rate – 6.95%

Loan tenure – 20 years

MONTHLY EMI – 23,169

Total Interest paid for a home loan – 25.6 lakhs

What just happened? How much did Mr.Kumar save?

When Mr.Kumar applied for a Balance transfer via Ruloans, he

- ■ Saved up to 69,000 rupees (approx) per annum on his EMI amount, and

- ■ Saved up to 14 lakh rupees on total interest paid throughout his home loan.

This means he almost saved a lot of his hard-earned money with this move. Isn’t this amazing?

If we have convinced you enough and you feel that a balance transfer is the best way for you to save a lot of money, then please do CLICK HERE & APPLY. Resource used to calculate EMI – https://emicalculator.net/