It’s about setting up kingdoms and making lives better for citizens.” This is the sentiment youth hold in a nation where nearly 93.6% are interested in being their bosses and growing themselves!

Sustainable success requires growth and expansion rather than an option in today’s ever-changing business world. Because a positive effect should be achieved, business growth necessitates strategic planning, risk management, financial astuteness, and dedication.

Discover how a business loan can accelerate your journey toward business growth.

Why Business Growth and Development Are Vital

- Driving Profitability: Expanding your business often leads to increased revenue and profitability. By reaching new customers and markets, you can tap into fresh revenue streams, reduce reliance on a single market, and maximize your return on investment.

- Market Leadership: Business growth and expansion can help make you a front-runner in an industry. A wider footprint and diversified product offerings or services lead to higher recall rates among consumers, fostering customer allegiance.

- Attracting Investment: Companies with organic growth usually attract the attention of potential investors and stakeholders. Funding and partnerships may be attracted to your business if it shows a strong growth trajectory.

- Enhanced Resources: Business growth and expansion allow for more excellent resources, such as expert employees, technological advancement, and economies of scale, leading to increased efficiency and innovation.

Top 10 Strategies for Business Growth

- Utilize a Business Loan: A business loan can be a powerful investment tool for growth and expansion. It provides the financial resources needed to expand your offerings, scale marketing efforts, upgrade technology, enter new markets, or bolster working capital. Consider applying for an online business loan to streamline the funding process and gain quick access to necessary capital.

- Diversify Product/Service Offerings: Diversifying your product or service mix attracts more users and opens more revenue channels. Consider introducing supplementary products, types, or whole new offerings.

- Enter New Markets: Geographical expansion allows you to diversify revenue streams, reach untapped markets, and capitalize on emerging opportunities.

- Focus on Customer Retention: While it is essential to draw in more customers, retaining those you already have is equally important. Try using loyalty programs, personalized communication, and outstanding client service.

- Invest in Social Media Marketing and Branding: Effective social media marketing and branding efforts can significantly boost your online business’s growth as they take maximum advantage of the vast online market.

- Form Strategic Partnerships: Collaborating with another business might help broaden your venture’s target group, and your shared resources will grow your venture’s credibility.

- Embrace Digital Technologies: Investing in technology solutions will help maintain competitiveness and enhance operational effectiveness.

- Improve Operational Efficiency: To prioritize growth initiatives that are essential for business expansion, streamline processes, automate tasks, and optimize resource allocationを, freeing up available resources.

- Invest in Employee Development: Invest in training and development programs for natural growth, as good, hardworking workers are needed.

- Innovate: To remain competitive and meet changing client demands, continuously roll out innovations in your products, services, and processes.

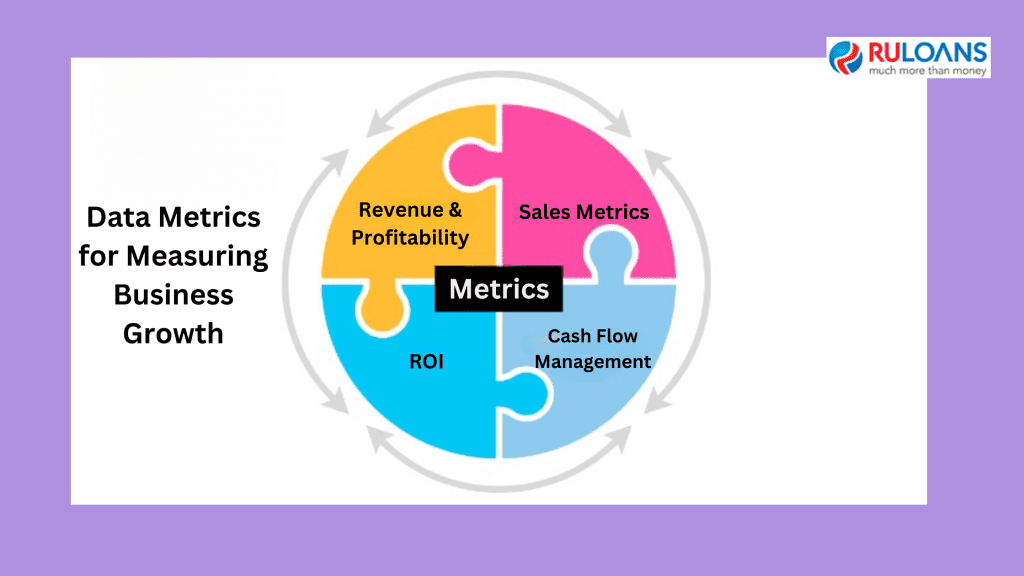

Data Metrics for Measuring Business Growth

- Revenue and Profitability: Increased revenue and profitability indicate business growth.

- Sales Metrics: Metrics like conversion rates, average transaction value, and sales growth rate reflect the effectiveness of your sales process.

- Return On Investment (ROI): Measuring the ROI of initiatives helps assess their effectiveness.

- Cash Flow Management: Efficient cash flow management is crucial for growth. Metrics like accounts receivable turnover and inventory turnover highlight efficiency.

Conclusion

Business growth and development are essential for long-term success. A business loan can be a valuable tool to fuel your expansion efforts. By choosing to apply for business loan, you can secure the necessary funds to reach new customers, enter new markets, and enhance your product or service offerings. Contact Ruloans today to explore how we can support your business expansion goals with our industry-leading financial solutions and expertise. Let’s embark on this growth journey together.